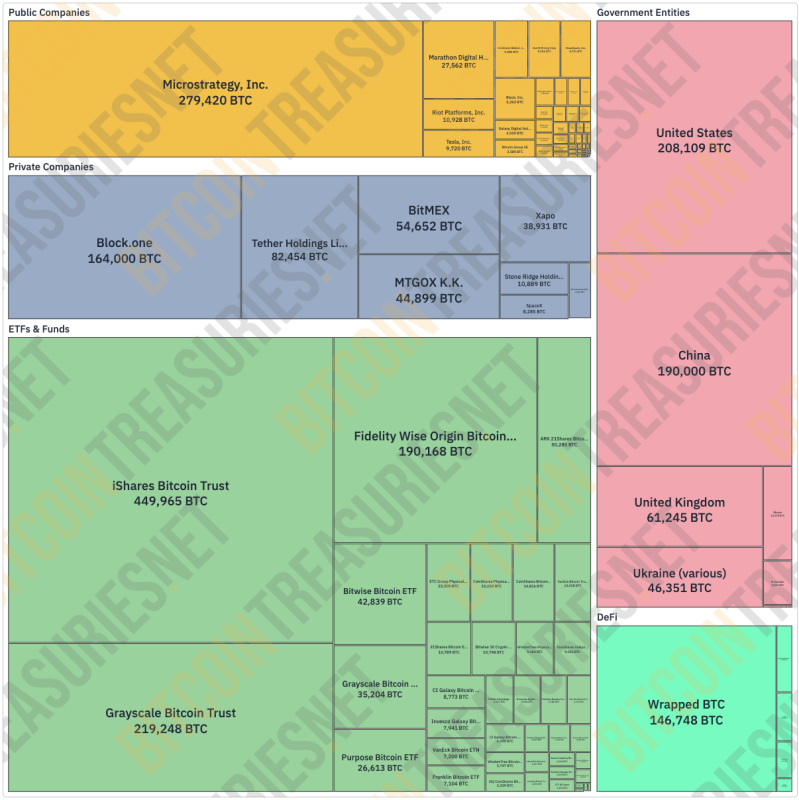

| Before we get to the charts, it's important people understand the role real-estate plays in China. 62% of all savings for Chinese people is in real estate. Real estate collateralizes most loans. When including real estate related industries, real estate makes up over 50% of the country's GDP. It's everything for many there, and the bubble is bursting with Evergrande (the largest real estate developer) which is defaulting on its debts. China is desperately trying to control the meltdown and stop the contagion, but for how long? We know they host the Olympics next year, so don't expect a Taiwan invasion or anything but their best efforts until then. The Olympics is also where they want to debut their digital Yuan to the world. They tell us everything is fine, but there are some whispers. Take a look at this chart: So...what do you think happens when this selling stops? There's been an unprecedented amount of selling since late November. For what? I'm going to assume that's both the India [quasi] crypto ban, and mostly the real estate unravelling in China. Lot's of people are seeing their life savings dissipate, and many ceo's are being asked to cover company debts with their own personal money. Only in China lol: https://www.koreatimes.co.kr/www/world/2021/10/683_317726.html Here's the US version of that chart meanwhile, and Europe looks about the same. Here's an interesting one. Smart money continues to hold the vast majority of their coins confirming a mid-bull market signal. With entities classified as smart money, whales and LTHs, consisting of those who began to accumulate bitcoin more than a year ago, we can track their behavior by the (CDD) metric. And then lastly my favorite chart which I've included in previous posts showing beautiful divergence: Almost lookie like a favorable parabola is forming The on-chain data continues to paint a picture the opposite of May's drawdown or any drawdown 30% or more over the last decade for that matter. I think we've nailed the reason for the recent selloff being Asia, and when that historical change in selling stops, we will gap up quite violently. Final FUD will be regulation of course, but I believe that benefits bitcoin in a tinfoil post I wrote recently which I'll link below. Otherwise HODL. Buy bitcoin with money you can't afford to lose. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments