On this week’s episode of The Market Report, Cointelegraph’s resident expert discusses if Bitcoin is safer than the U.S. dollar, considering the impending risk of debt default.

On May 17’s episode of The Market Report, analyst and writer Marcel Pechman discusses whether Bitcoin (BTC) is safer than the United States dollar, considering the risk of the U.S. government defaulting on its debt. He also covers why Bitcoin’s $28,000 resistance will not be a walk in the park and, finally, what is happening between Celsius, Ethereum and Lido staking. The show airs every Tuesday on the Cointelegraph Markets & Research YouTube channel.

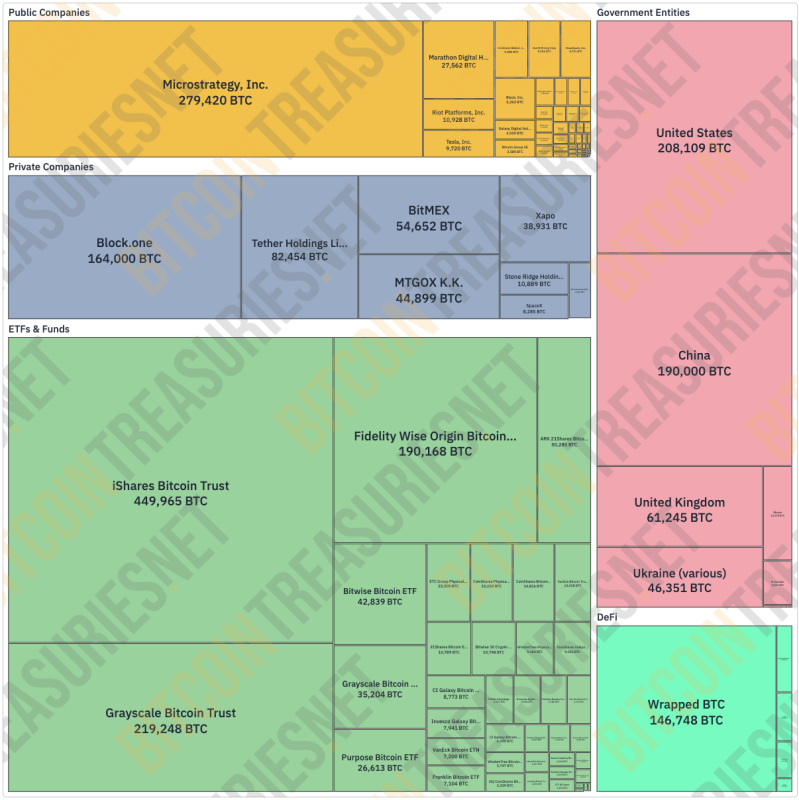

The first news article covered discusses a Bloomberg Markets survey showing Bitcoin as a top three asset in the event of a U.S. debt default. For Pechman, it is no surprise that Bitcoin trumps fiat currencies in investors’ picks, considering the central banks from the eurozone, Japan, Canada, England and Switzerland boosted their borrowing programs from the U.S. Federal Reserve in March 2023. There’s a high correlation to fiat currencies, putting the asset class at significant risk if a U.S. debt default happens.

Pechman predicts that investors’ allocations in gold would be 10x higher than Bitcoin’s due to the cryptocurrency’s lower market capitalization and high volatility. On the positive side, 11% of retail investors would add Bitcoin to their portfolio in the event of a government shutdown versus 46% for gold. What are the odds of Bitcoin breaking above $100,000 in the case of a government shutdown? No spoilers — check the show.

On to the show’s next topic: Pechman discusses why Bitcoin’s $28,000 resistance will likely prove stronger than expected. The recent correction down to $25,800 was probably caused by high transaction fees, but Pechman argues that the network worked exactly as intended and that high fees are the network’s defense against spamming.

The problem holding back a quick recovery above $28,000 is professional traders’ positioning using derivatives. Before the event, whales and market makers were already neutral-to-bearish.

In the final part of The Market Report, Pechman explains failed crypto lending platform Celsius’ $780 million Ether (ETH) movement from the Lido staking platform. No one knows if the Ether will be sold at market and eventually paid out in U.S. dollars to Celsius creditors

Don’t miss out! The show is available exclusively on the Cointelegraph Markets & Research YouTube channel.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here and during the show are the analysts’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments