The first Bitcoin mining was a well-thought-out idea by enthusiasts of new technologies. Now, such people have become famous entrepreneurs — digital art owners, gamers, IT security solution developers, and other professionals. The coverage of our lives by this new technology is truly impressive. Even if you are not a financier, you must understand that cryptocurrency projects are integrated with various industries, including education, marketing, and banking.

Nowadays, miners earn more than any successful banker. Just check the statistics of the ICOholder website to be sure. No doubt, market coverage will grow in the next 5-7 years, even despite the risks. This means that thousands of enthusiasts will be interested in cryptocurrency. Further growth of this ecosystem cannot be stopped, even taking into account legal issues — the biggest beneficiaries of most mining projects are investment funds and hackers.

Why Bitcoin is Growing in Popularity

Although the Bitcoin phenomenon arose 10+ years ago, people still believe that the digital-currency venture is behind new technology enthusiasts. Any experienced financier can expose this fake. Now, the growth in the value is primarily due to investment funds. We decided to look into this problem in more detail and checked several facts. Here are the specifics of the growth in popularity of this technology in the next 10 years:

- Increasing the security of transactions. Initially, miners received up to 50 bitcoin rewards for completing blocks. In 2012, this value was reduced by 2 times. Since 2016, enthusiasts could count on 12.5 BTC, and since May 2020 — 6.25 BTC. Another halving is for 2024.

Paradoxically, the more people prefer cryptocurrency, the more secure this tool becomes. From 2009 to 2021, the Bitcoin Core software has been downloaded over 5.5 million times worldwide. This is a good indicator of positive growth. Due to this specificity, professionals who are actively developing the digital ecosystem have become interested in cryptocurrency projects.

- Globalization of markets. The innovative Blockchain technology has caught the interest of many shop owners. This payment tool is associated with innovation. So, the implementation of BTC can be the reason for increasing brand awareness. Now, with a bitcoin wallet, people pay for computer games in the online stores Steam and Xbox Live, order coffee at Starbucks, wings at Canadian KFC outlets, or buy food at the American Whole Foods.

- Increasing confidence in the payment tool. Previously, few people took cryptocurrency seriously. This payment tool has been described as financial misconduct.Such prejudices slow down the development of the ecosystem. Of course, Bitcoin has been the most popular means of payment on the DarkNet for many years. But the trends have changed. Now, fewer people deny that Bitcoin may eventually become the currency issued by central banks.

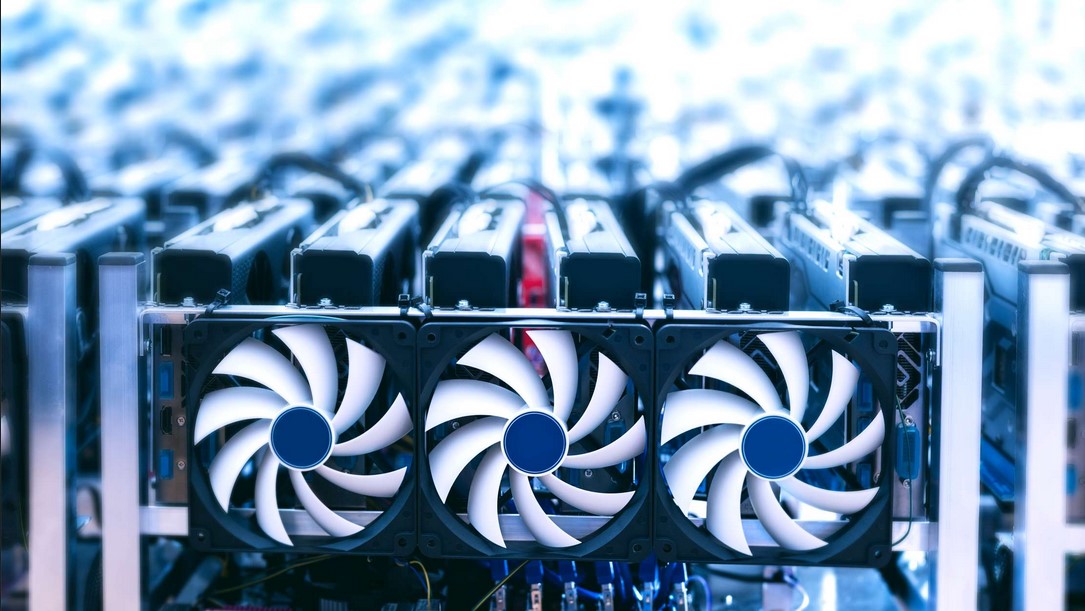

- High profit. Bitcoin is a speculative asset. Wealthy investors will always be in a better position because they can affect the value of cryptocurrency and monetize it at any moment. The price of BTC soared 20% just because Elon Musk used the hashtag #bitcoin on his Twitter profile. The largest mining structures are located in China and the USA. For example, Whinstone US and Northern Bitcoin AG have joined forces to build a 40.5-hectare farm (57 football fields) in Texas/ShutterStock. The growth of these two projects will certainly affect the value of each miner's digital assets.

- Legalization. Governments in some countries say about using Blockchain — the creation of their own cryptocurrency, or at least tokens used, for example, to approve official documents. We’re talking about China, Ecuador, Tunisia, Senegal, Sweden, Estonia, Russia, Japan, Venezuela, and Israel. For example, the authorities of El Salvador are ready to make Bitcoin an official means of payment.

In 2019, the European Union Intellectual Property Office announced that it would use Blockchain technology to prevent forgery. In March 2020, the Distributed Ledger Group under the then Ministry of Digitalization prepared a white paper that looked at the use of Blockchain technology to validate documents — hold bonds and bills.

Given the volatility and unpredictability, it’s impossible to predict the profitability of BTC or ASICs in 2022. The decision on whether to start mining this year should be made taking into account the factors affecting the cryptocurrency market and the available financial tools.

Key Takeaway

Predicting the cryptocurrency's future is a thankless task, like guessing. Although the prospects of this technology are undeniable. First of all, it is worth considering the legislative perspectives regarding the cryptocurrency ecosystem, which can both facilitate mining and complicate the possibility of doing this activity.

No less important are the announcers of the leading manufacturers of equipment. Top companies are unlikely to stop the production of video cards for specific coins. In the near future, popular platforms are expected to be updated, as well as make important decisions that affect the general state of the cryptocurrency market.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments