The US Securities and Exchange Commission’s (SEC) annual enforcement report for Fiscal Year (FY) 2023, detailing the filing of 784 enforcement actions, orders for nearly $5 billion in financial remedies, and distribution of nearly $1 billion to harmed investors, has sparked a fervent response from the XRP community.

SEC Chair Gary Gensler emphasized the significance of the Enforcement Division’s role in investor protection, asserting, “The investing public benefits from the Enforcement Division’s work as a cop on the beat. FY 2023’s results demonstrate the Division’s effectiveness—working alongside colleagues throughout SEC—in following the facts & the law wherever they lead to hold wrongdoers accountable.”

XRP Lawyer Community Slams Gensler And The SEC

This statement, however, was met with stern criticism from prominent figures within the XRP legal community. John E. Deaton, representing the XRP community in the ongoing Ripple vs. SEC case, directly challenged Gensler’s leadership, stating, “Want to truly protect investors? Then resign.”

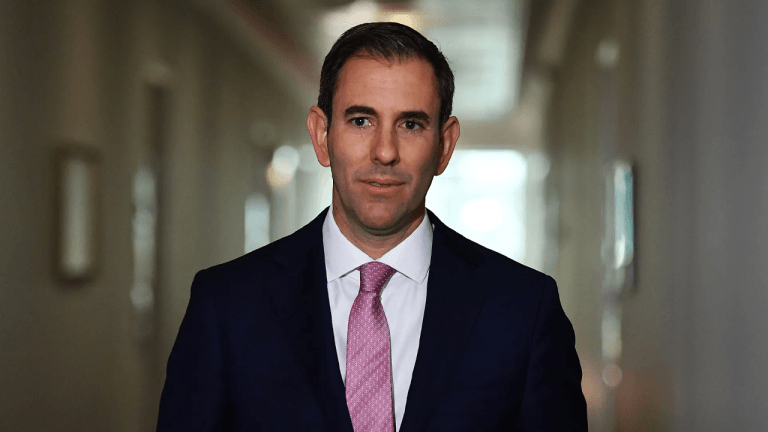

Bill Morgan, an Australian lawyer affiliated with the XRP community, scrutinized the SEC’s effectiveness, particularly in the LBRY case, questioning the actual benefit to investors: “How much did you obtain from the LBRY case? Nothing so far because you drove LBRY into insolvency. What were the SEC’s taxpayers’ funded legal costs? A lot. Who was protected? Nobody. Who was hurt? Investors. What was achieved of worth from the case? Nothing? What was the opportunity cost? Not using those agency resources to prevent real scams like FTX.”

Notably absent from the SEC’s report is the Ripple case concerning XRP’s classification as a security. This is due to the fact that the remedy phase for the case is still pending and has only recently been given a timetable, as Bitcoinist reported.

Fred Rispoli, founder of HODL Law and a pro-XRP lawyer, recently commented on the SEC vs. Ripple case, indicating another reason why the SEC may not have included the Ripple case in its report: “SEC vs. Ripple. The remedies-related discovery schedule is set. There is no chance of a 2nd Cir. ruling on an appeal by either party (if one is ever filed) before mid-2026. Think of everything that will happen between now and then. Game Over, SEC. You lost.”

SEC’s Annual Enforcement Report

The SEC’s Fiscal Year 2023 enforcement report details a comprehensive approach to regulating the crypto asset securities sector. This year’s actions by the SEC encompassed a variety of issues, including large-scale frauds, unregistered offerings, and noncompliance among crypto-asset intermediaries.

The Division’s enforcement actions were notably rigorous against massive crypto frauds. High-profile cases included charges against Terraform Labs and its founder Do Kwon, as well as against Richard Heart and his controlled entities Hex, PulseChain, and PulseX. The case of FTX CEO Samuel Bankman-Fried and other FTX executives is also mentioned as a significant focus on addressing major frauds within the crypto space.

In addition to combating fraud, the SEC also targeted unregistered securities offerings in the crypto sector. This included actions against several firms for allegedly offering unregistered securities through crypto asset lending and/or staking programs.

Notable among these were Genesis/Gemini, Celsius, Kraken, and Nexo. Settlements were reached in some of these cases, with Kraken agreeing to pay $30 million and Nexo $22.5 million in civil penalties.

The enforcement report also highlighted the SEC’s actions against crypto asset intermediaries. The SEC brought charges against entities like Beaxy, Bittrex, Binance, and Coinbase, emphasizing the need for compliance with securities laws. This marked an increased focus on the regulation of platforms providing a blend of exchange, broker-dealer, and custodial services in the crypto market.

Another significant aspect of the SEC’s enforcement was against illegal celebrity touting of crypto asset securities. Influencers and celebrities, including Paul Pierce, Kim Kardashian, Lindsay Lohan, Jake Paul, and others, were charged for promoting crypto securities without adequate disclosures about compensation received for these promotions.

The report also mentioned the SEC’s victory in the LBRY case. A federal court upheld the SEC’s position that LBRY, Inc. had offered and sold LBC tokens in violation of the registration provisions of federal securities laws.

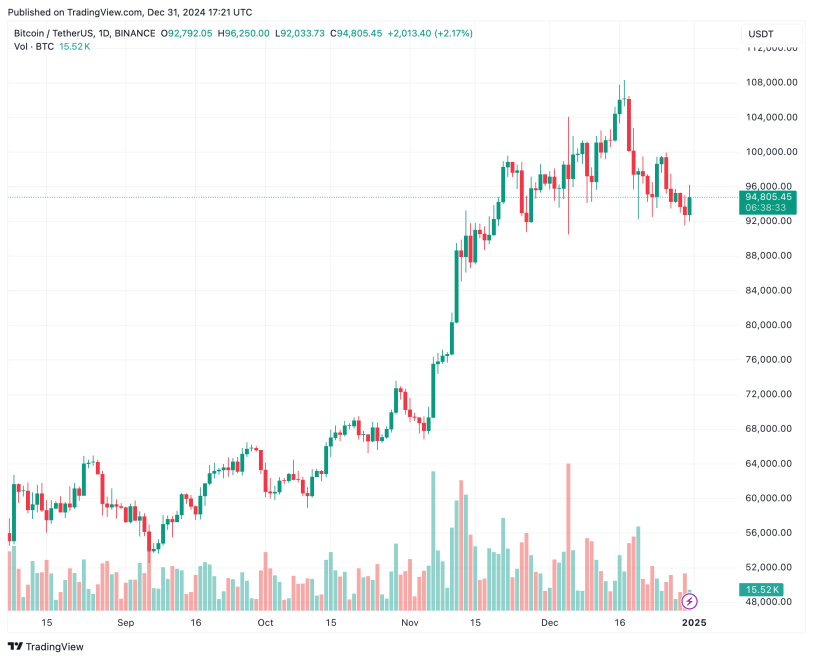

At press time, XRP traded at $0.6337.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments