The Danish Financial Supervisory Authority (FSA) has ordered Saxo Bank to dispose of its inventory of crypto assets, following a decision that the bank’s trading in these assets at its own expense is found to be outside the “legal scope” of banks.

The bank had been holding a portfolio of digital assets as a hedge to counter market risk associated with its crypto-active products. But Danish authorities are not pleased with its decision to do so.

Saxo Bank To Liquidate Crypto Holdings

Saxo Bank allows its customers to trade a range of crypto-active products through the bank’s platform, including exchange-traded funds (ETFs) and exchange-traded notes (ETNs), as well as speculation on digital assets marketed under the designation “crypto cross.”

However, the Danish Financial Supervisory Authority has found that unregulated trading in digital assets can create “distrust” in the financial system, and it would be unfounded to legitimize such trading.

The decision underscores the challenges faced by banks and financial institutions seeking to engage in crypto-related activities, particularly in the absence of clear regulatory guidance.

While the industry continues to attract significant interest from investors and businesses around the world, regulatory compliance, and risk management will be essential to ensure the long-term viability and sustainability of such activities.

Saxo Bank is one of the largest retail forex brokers in the world, with a presence in more than 170 countries. The bank has been active in the cryptocurrency market for several years, offering its customers access to a range of digital assets through its trading platform.

Given this, the bank’s decision to dispose of its inventory of digital assets is likely to have a significant impact on its operations and profitability.

Denmark Implements AMLD5 Regulations For Digital Assets

Denmark has recently taken a significant step in regulating the cryptocurrency industry by implementing the MiCAR (Markets in Crypto-Assets Regulation) roadmap as well as the European Union’s Fifth Anti-Money Laundering Directive (AMLD5)

Under the Directive, providers of exchange services between virtual currencies and fiat currencies, providers of virtual wallets, providers of exchange services between virtual currencies, providers of virtual currency transfers, and issuers of virtual currencies are all required to comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

The implementation of AMLD5 is designed to address the risks associated with the anonymity and decentralization of digital assets, which can make them attractive to criminals seeking to launder money or finance terrorist activities.

By subjecting crypto-related businesses to AML and CTF regulations, Denmark aims to reduce the risk of these illicit activities and protect the integrity of its financial system.

Under AMLD5, crypto-related businesses are required to register with the Danish Financial Supervisory Authority and implement a range of measures to prevent money laundering and terrorist financing. These measures include customer due diligence, ongoing monitoring of transactions, and reporting of suspicious activities to the authorities.

These measures underscore the growing recognition of the industry as a legitimate asset class and highlight the need for responsible regulation to ensure their long-term viability and sustainability.

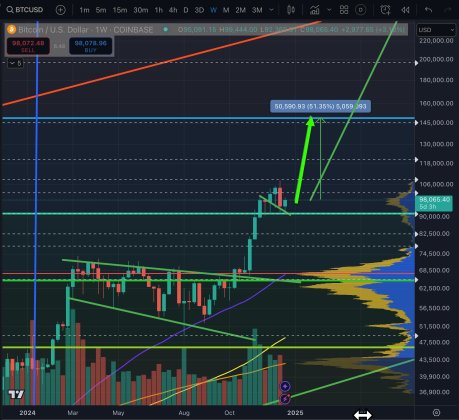

Featured image from Unsplash, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments