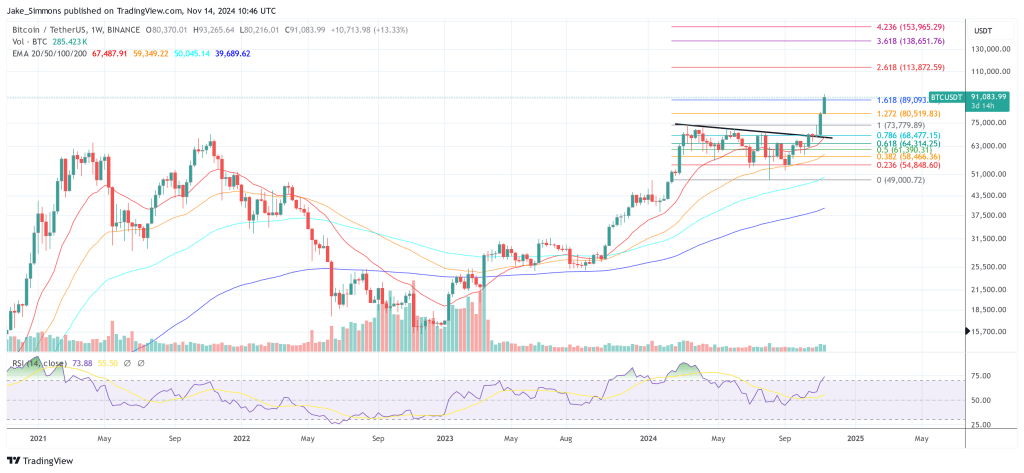

![[SERIOUS] Have we bottomed? Information from 10 key bottom indicators (November 2022 edition) [SERIOUS] Have we bottomed? Information from 10 key bottom indicators (November 2022 edition)](https://b.thumbs.redditmedia.com/M4RsvHvac-cu6C7M64fUDj8BAXyN3OrZloeHhip5tRo.jpg) | In this post you will find my analysis of 10 key bottom indicators in this space. All 10 indicators have successfully identified the bear market bottoms in the past. This month, 10/10 bottom indicators state that the bottom is in. So technically, history is still repeating itself, which might be because the severity of the macro environment is offset by the insane level of crypto adoption we are seeing, but that is obviously pure speculation. There were some crucial updates this month, as the Monthly MACD started shifting in October (see #2) and the total crypto market cap reclaimed the 200 weekly moving average (see #4), similar to how it did in prior bears. Is this a guarantee that the bottom is in? No, of course not. The macro is scary and who knows what will happen. I am a scientific researcher and I love and respect data. Data can help you get better odds and pick a "better" time to invest. But history does not have to repeat. The confluence across the indicators is remarkable though. I hope this post is educational and informative. If you hate TA, please stay away. Prepare for a TA overload. ----------- (1) The Bitcoin Rainbow Chart - YES In tradition, I will start with the Bitcoin Rainbow Chart, the most famous LGBT analysis chart that started as a meme. The 'Basically a Fire Sale' has held and marked the bottom in 2015, 2016, 2019, 2020. The same thing could very well be happening again now in 2022. We dipped our toes below but the lower band is holding. I see no major difference relative to prior bears at this moment. (2) MACD on the monthly timeframe - YES The MACD is a trend-following indicator and can help gauge whether an asset is overbought or oversold, alerting traders to the strength of a directional move, and warning of a potential price reversal. The MACD is displayed under the Bitcoin Monthly chart below. Every previous bear market when on the Monthly timeframe the trend shifted and the histogram had peaked (dark red bars ended, lighter red bars started), the bear market bottom had already been in. I highlighted these three moments with a vertical green line. The MACD peaked again in October 2022. This is a great new sign! Bitcoin Monthly (green vertical lines are key trend shifts in the MACD during a bear market) (3) Pi Cycle Indicator - YES I can be short here. This indicator uses moving averages and has an insane track record of identifying when the top is and when the bottom is. It flashed the bottom over the summer, 25 days after Bitcoins' June low on June 18. (4) Total crypto market 200 weekly moving average - YES The key moving average in trading is likely the 200 weekly moving average. The total crypto market 200 weekly moving average has always acted as key support and we have never been below it for a long period of time. It is in that sense more accurate than the Bitcoin 200 weekly. We spent a few moments below it but just blasted through again, similar to the 2018 bear and even the 2020 COVID low. Total crypto market cap (200 moving average in green) (5) Hash Ribbons indicator - YES This Hash Ribbons indicator informs us on moments of capitulation of miners. After this capitulation has historically been an amazing moment to buy. This summer, on 19 August, it flashed again, after 71 days of Miner pain. (6) Bitcoin Weekly RSI – YES RSI marks the strength in the market. It was at a historic low in June 2022 and has since then bounced quite hard, replicating the pattern we saw during the two previous bear markets. Bitcoin weekly + RSI (key buy moments highlighted in red) (7) Mayer Multiple - YES This indicator refers to the multiple of the current price over the 200 daily moving average. The 0.50 level has marked the bottom of the previous two bears and we bounced hard from it in a near identical manner relative to the two previous bear markets. (8) Puell Multiple indicator - YES Ill keep it simple here because the technicals are difficult. The Puell Multiple reflects miners revenues and whether they are higher relative to history (red band) or lower relative to history (green band). We were in the green band over the summer and bounced out. Every time Bitcoin left the green zone, the bottom was already in. (9) The 20 week x 100 week moving average cross - YES This will sound weird, but everytime the 20 weekly moving average crosses down the 100 weekly moving average, the bottom of the bear market was in within a week. It happened again in June, like magic. Bitcoin weekly (orange: 20 weekly moving average, green: 100 weekly moving average) (10) Sentiment - YES A key ingredient for a bottom area is that investors and consumers needs to be extremely fearful. The Fear & Greed index has clearly shown that people are very fearful. We had the longest period of extreme fear on record and are still at fear now despite a good bounce. Im going to add a bit of confluence here from stocks. The confidence in the economy of CEO's in the United States is at an extreme low. When does that happen? At/near bottoms. See the chart below. Association between CEO confidence in economy and S&P 500 Oh, and a little confluence from this subreddit too, because this sub has been: [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments