SG-FORCE, a subsidiary of Societe Generale (SG), a French multinational investment bank, has partnered with Switzerland-based fintech company, METACO, to ramp up its institutional digital assets market activities.

METACO announced the development on Thursday on its website.

The Swiss company provides digital asset management technology and infrastructure to financial and non-financial institutions.

Additionally, METACO helps companies issue, invest in and manage digital-native security tokens created on public blockchains.

SG-FORGE said the collaboration will enable it to lead efforts to integrate security tokens into traditional finance.

A security token is a physical or digital device that uses two-factor authentication (2FA) to determine the originality of a user's identification details during a login process.

“Since 2019, Societe Generale and its subsidiary SG – FORGE structured several native security token issuances deployed on blockchain for their clients such as the European Investment Bank's (EIB) €100 million digital bond issued in 2021,” SG FORCE explained in the statement.

‘A Solid Foundation’

Moreover, the French subsidiary intends to increase its digital asset marketplace offerings with support from Harmonize, METACO’s bank-grade digital asset custody and orchestration platform.

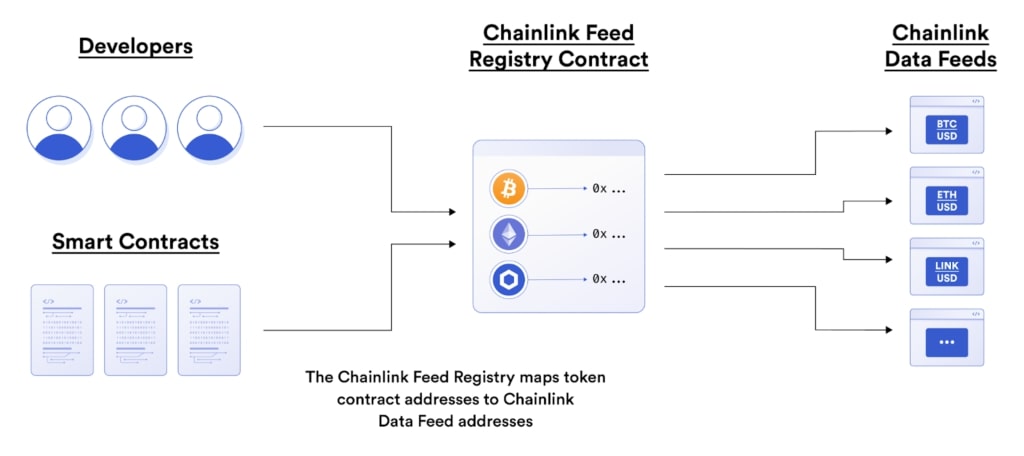

METACO explained that Harmonize makes it possible to connect financial institutions to the decentralized finance world.

Furthermore, the platform powers activities such as cryptocurrency custody and trading, staking, tokenization and smart contract management, the Swiss technology and infrastructure provider said.

Jean-Marc Stenger, the Chief Executive Officer of SG-FORGE, said SG is seeking to build “a solid foundation” for its digital asset activities through the partnership.

Stenger noted that METACO’s secure infrastructure makes that possible.

“Bridging the digital asset industry and traditional finance requires a multifaceted approach incorporating institutional-grade technology, regulation, as well as industrial capacities,” Stenger explained.

On top of that, Adrien Treccani, the CEO and Co-Founder of METACO, noted that the Swiss company is proud to join forces with SG-FORGE to provide its infrastructure to support the bank’s vision.

Additionally, Alexandre Fleury, the Co-Head of Global Markets Activities, Societe Generale, said the partnership proves SG’s capacity to “step-by-step implement a truly innovative technology.”

Earlier in the year, SG launched a new acceleration programme for emerging companies to improve customer experience services in the transaction banking sector.

Meanwhile, in June 2021, Societe Generale teamed up with Kyriba, a cloud-based finance and IT solutions provider, to launch a new treasury management solution.

SG-FORCE, a subsidiary of Societe Generale (SG), a French multinational investment bank, has partnered with Switzerland-based fintech company, METACO, to ramp up its institutional digital assets market activities.

METACO announced the development on Thursday on its website.

The Swiss company provides digital asset management technology and infrastructure to financial and non-financial institutions.

Additionally, METACO helps companies issue, invest in and manage digital-native security tokens created on public blockchains.

SG-FORGE said the collaboration will enable it to lead efforts to integrate security tokens into traditional finance.

A security token is a physical or digital device that uses two-factor authentication (2FA) to determine the originality of a user's identification details during a login process.

“Since 2019, Societe Generale and its subsidiary SG – FORGE structured several native security token issuances deployed on blockchain for their clients such as the European Investment Bank's (EIB) €100 million digital bond issued in 2021,” SG FORCE explained in the statement.

‘A Solid Foundation’

Moreover, the French subsidiary intends to increase its digital asset marketplace offerings with support from Harmonize, METACO’s bank-grade digital asset custody and orchestration platform.

METACO explained that Harmonize makes it possible to connect financial institutions to the decentralized finance world.

Furthermore, the platform powers activities such as cryptocurrency custody and trading, staking, tokenization and smart contract management, the Swiss technology and infrastructure provider said.

Jean-Marc Stenger, the Chief Executive Officer of SG-FORGE, said SG is seeking to build “a solid foundation” for its digital asset activities through the partnership.

Stenger noted that METACO’s secure infrastructure makes that possible.

“Bridging the digital asset industry and traditional finance requires a multifaceted approach incorporating institutional-grade technology, regulation, as well as industrial capacities,” Stenger explained.

On top of that, Adrien Treccani, the CEO and Co-Founder of METACO, noted that the Swiss company is proud to join forces with SG-FORGE to provide its infrastructure to support the bank’s vision.

Additionally, Alexandre Fleury, the Co-Head of Global Markets Activities, Societe Generale, said the partnership proves SG’s capacity to “step-by-step implement a truly innovative technology.”

Earlier in the year, SG launched a new acceleration programme for emerging companies to improve customer experience services in the transaction banking sector.

Meanwhile, in June 2021, Societe Generale teamed up with Kyriba, a cloud-based finance and IT solutions provider, to launch a new treasury management solution.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments