I started to study Bitcoin 12 years ago. Reddit was the place where I posted my explorations. My model has evolved now into a full theory of Bitcoin behavior that can explain in a scientific coherent and falsifiable way all the main on-chain parameters and describe the growth of Bitcoin adoptions.

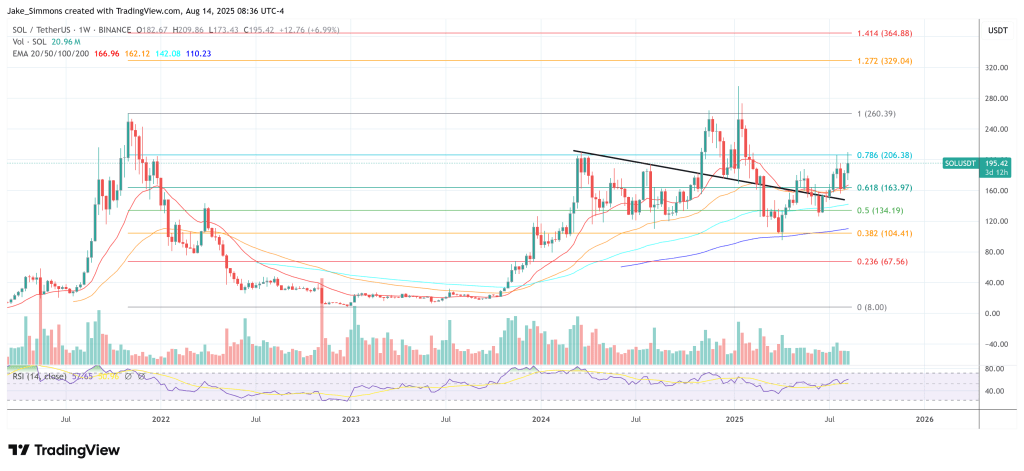

The graph below explains the theory in a summarized way and shows the main data that supports the theory. Price, hash-rate, and addresses (we used addresses above a cut-off to eliminate dust addresses) are all power laws of each other and of time.

They all interact and affect each other in a continuous feedback loop.

Power laws are mathematical expressions of the form y=A x^n and are ubiquitous in nature but also in social phenomena and many parameters related to how a city or a nation grows.

They are so common because it can be shown mathematically and physically that they emerge any time you have some kind of process where the output becomes the new input in an iterative process.

This is exactly what happens with Bitcoin where for example the hash-rate now affects the hash-rate later in an infinite loop. So it is amazing but also perfectly consistent with the nature of Bitcoin to have power laws governing its behavior.

The interaction is supported by the diagram below which is well-known in the community and I didn't invent but I use to illustrate how the theory works.

The theory basically is a mathematical expression, based on logic, physics, and mathematics of the feedback loop below.

- Initially Bitcoin needed to be accepted and adopted by the first users in Satoshi circle.

- The "value" (now the "Price" that can be checked 24/7 online) increased with the square of the users (the empirically measured value is more like 1.95 but we round all the following power numbers to their integer number for simplicity). This is a confirmation of the theoretical result called the Metcalfe law.

- The increase in price brings in more resources in particular mining power and capabilities.

- The increase in price decreases the time to mine a block but because of the "Difficulty Adjustment," the hash-rate necessary to mine a block is changed in an iterative fashion. Because the mining is barely profitable the compensation mechanism needs to be proportional to the increase in price that increased by P=users^2 so we have hash-rate=Price^2 (this is exactly what is observed where the empirical value of the power is close to 2 or Price=hash-rate^1/2).

- The increase in hash-rate brings more security to the system which attracts more users. Now some readers may say that most people do not buy Bitcoin because of "security" but indirectly they do because if it was not a secure system nobody would invest enormous value in it. So yes, the security of the system directly or indirectly brings in new users.

- The users grow with the power of 3 in time. This is also a new result of the theory. Most models of Bitcoin adoption invoke S-curve type of growth. S-curves are typical of the adoption of many technologies like TVs, refrigerators, cars, cell phones, and so on. Bitcoin doesn't follow a S-curve that is initially exponential. It follows a power law of 3 in time. It turns out many phenomena that have an underlying S-curve mechanism of adoption or spread (in the case of a virus for example) if they have a curbing mechanism they become power laws instead. In the case of Bitcoin both the "Difficulty Adjustment" and the risk involved in any type of investment is that curbing mechanism, this is why we observed empirically that the growth of adoption of Bitcoin is a power law of 3 in time. There is extensive literature showing examples of this type of curbing phenomenon in the spread of diseases when risk is involved for example AIDS (Bitcoin is not AIDS but these studies show that if the spread of a disease involves some kind of decision making like having sex with a partner it makes the disease spread like the power of 3 in time instead of a S-curve or other type of logistic curves).

- This power law growth of adoption then (together with the previously explained power laws) explains why we observed the other power laws in time: Addresses=t^3, Price=Addresses^2=(t^3)^2=t^6, Hash-Rate=Price^2=(t^6)^2=t^12.

This theory explains the long-term behavior of Bitcoin and it has many consequences. For example, scale invariance that if you are not familiar with please google it.

Basically, it says that the system will continue to scale up as it grows in the same manner and this is why we can use scale invariant to make predictions and the growth of the system given it has been expressing over 9 orders of magnitude it will continue to happen almost for sure for other 1 or 2 orders of magnitude (it will take about 10 years to reach 1 million BTC). As incredible as this sounds then everything important about the system, price, hash-rate, and adoption is predictable in the long term.

There is much more to the theory (for example why we see so well aligned bottoms following the power law). I'm in the process of writing both a science article (so I go through the process of peer review of these ideas and make sure they have a scientific validity) and a popular book on the topic (in the style of my country-man Galileo "Dialogue Concerning the Two Chief World Systems").

PS The bubbles are not part of the theory, at least not yet, and they are understood as temporary perturbations or disturbances of the general power law in time. After the bubbles are over the price always comes back to the general trend. The theory and the empirical evidence support this.

https://preview.redd.it/lri0mojl0hoc1.png?1661&format=png&auto=webp&s=475acc9a0080582097d91fca57bbb0f3f651314d

Comments