The CEO of investment management firm Devere Group has warned that the U.S. debt ceiling dramas have weakened the U.S. dollar’s “global reserve currency’s credibility and reputation as a ‘safety asset.’” He cautioned that Congress’ debt ceiling deal “does not solve the underlying political challenges facing the U.S. and its economy.”

‘Using the Country’s Debt as a Political Weapon Undermines Confidence in U.S. Government’

Nigel Green, the CEO of Devere Group, a financial services company headquartered in the United Arab Emirates, highlighted the challenges that the U.S. economy continues to face, despite Congress reaching a debt ceiling deal, in an opinion piece published by Newsmax Friday. The deal, which President Joe Biden signed into law on Saturday, prevented a potential national debt default, which could have occurred on June 5 if a resolution had not been reached, according to Treasury Secretary Janet Yellen.

“So, let’s be clear: this down-to-the-wire deal struck this week to raise the debt limit — and only until January 2025 — does not solve the underlying political challenges facing the U.S. and its economy,” Green stressed. “The main issue is that lawmakers in recent times have had, and continue to have, little incentive to reach agreement,” he continued, elaborating:

It’s an increasingly polarized political landscape, which is being amplified by algorithms and economic interests. I believe it’s a trend that will only intensify in the foreseeable future.

Green also noted that a presidential election is coming up in 2024, cautioning that the debt ceiling “political agreement” is “unlikely to be maintained for very long” if former president Donald Trump wins.

“Standoffs becoming a frequent occurrence will risk more government shutdowns, more restrictions on central bank independence and more damage to the U.S., and therefore global, economy,” the executive opined, adding:

Using the country’s debt as a political weapon, undermines confidence of investors in the U.S. government amid concerns about the government’s ability to properly manage its finances.

“This loss of confidence will mean that it becomes more difficult for the U.S. government to borrow money in the future, which could lead to higher interest rates and weaker economic growth,” he warned.

The Devere CEO also highlighted the risks to the U.S. dollar, stating:

Debt ceiling dramas also erode some of the current global reserve currency’s credibility and reputation as a ‘safety asset,’ which could have far-reaching repercussions for the U.S.

He recently argued that “debt ceiling crises are the ‘ultimate gift’ for America’s major geopolitical rival, China, which is seeking to promote the internationalization of its own currency and to position itself as a more stable and attractive investment option, in order to attract more international investment and capital inflows.”

Green emphasized that he is in favor of “debt ceiling reforms that take away the threat of a U.S. government default and all the implications of that, and reforms that make lawmakers in Washington truly accountable by automatically triggering spending cuts should the ceiling be reached.” However, he doubts “such reforms will come to fruition as a debt ceiling gridlock is a useful political theatre for lawmakers – on both sides – keen to push agendas.”

Do you agree with Devere CEO Nigel Green? Let us know in the comments section below.

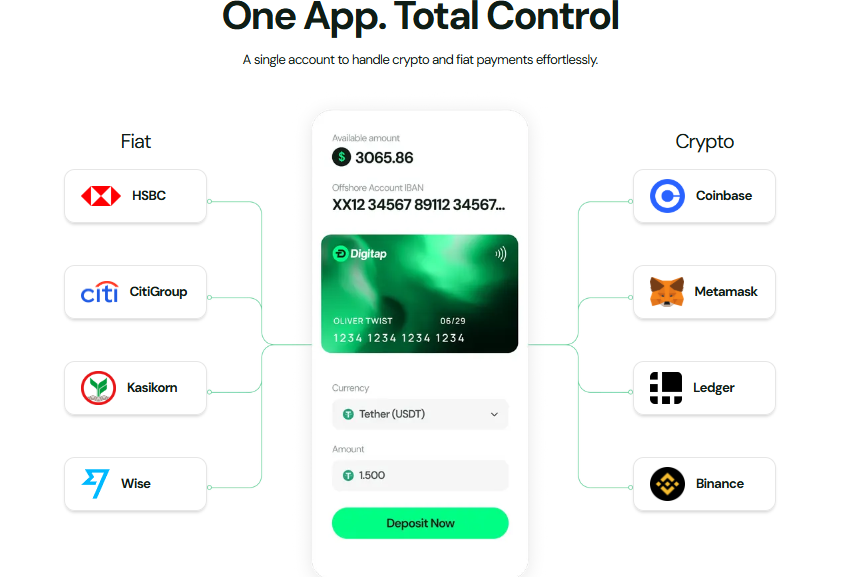

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments