One of the reasons people are excited about DeFi is that it allows users to approach investments the same way banks would. And with the advancement of decentralized finance, a flurry of exciting exchange platforms continue to pop up.&

However, with users constantly looking for better services and easier interfaces, only a few make it to mainstream adoption.&

If you want to trade cryptocurrency on decentralized exchanges (DEX), you have several options on almost every blockchain, and it can be challenging to know where to begin. This article highlights everything you need to know about SushiSwap, one of the most prominent DeFi platforms. Let's dive in!&

Executive Summary

- SushiSwap is a decentralized multi-chain exchange (DEX).

- SUSHI is the token tied to the SushiSwap exchange.&

- While Sushi initially started as a fork of Uniswap, the two exchanges have moved towards different product goals.&

A Brief Introduction to SushiSwap

SushiSwap (SUSHI) is a multi-chain decentralized exchange (DEX). The exchange started out as a fork of Uniswap that uses smart contracts to provide liquidity pools that allow users to trade crypto assets directly with no intermediary.&

Users can also become liquidity pool providers, supplying an equal-value pair of two cryptocurrencies in exchange for rewards whenever that pool is used.&

Sushi is a community-driven organization founded to address the "liquidity problem" of decentralized exchanges. This issue could be defined as the inability of various forms of liquidity to connect with markets in a decentralized manner and vice versa.

While other solutions make incremental progress toward solving the liquidity problem, Sushi's progress is intended to generate a broader range of network effects. Rather than focusing on a single solution, Sushi intertwines many decentralized markets and instruments.

So far, the core products are as follows: a decentralized exchange, a decentralized lending market, yield instruments, an auction platform, an AMM framework, and staking derivatives.&

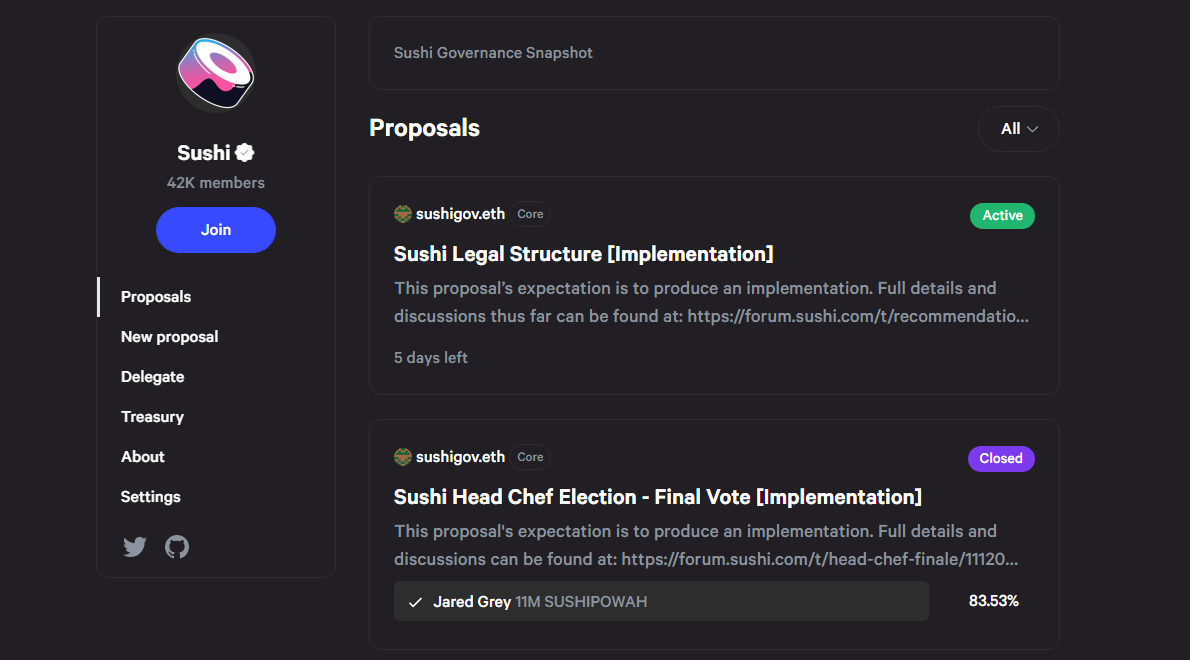

Sushi's products are designed so that the entire platform can continue to innovate on the collective foundations while maintaining the decentralized governance of SUSHI token holders.&

While the community votes on significant structural changes, our core team ultimately decides on day-to-day operations, pool and ratio rebalancing, business strategy, and overall development.

What Are Liquidity Pools

Liquidity pools are places where tokens are pooled so that users can use them to make trades in a decentralized and permissionless manner.&

Users and decentralized apps (dApps) that want to profit from their use create these pools. To pool liquidity, a user's funds must be equally divided between two coins: the primary token (also known as the quote token) and the base token (usually ETH or a stablecoin).

SushiSwap's liquidity pools allow anyone to provide liquidity to them in exchange for SLP tokens (SushiSwap Liquidity Provider tokens). A user would receive SUSHI-ETH SLP tokens if they deposited SUSHI and ETH into a pool.&

These tokens represent a proportional share of the pooled assets, allowing users to withdraw funds at any time. When another user uses the pool to trade between SUSHI and ETH, a 0.3% fee is deducted from the transaction. 0.25% of that trade is returned to the LP pool.

With each trade, the value of the SLP tokens, which represent the shares of total liquidity in each pool, is updated to add their value relative to the tokens used to trade. If there were previously 100 SLP tokens representing 100 ETH and 100 SUSHI, each token would be worth 1 ETH and 1 SUSHI (In the above example, both ETH and SUSHI have about the same price).

If you have read our Uniswap deep dive article and noticed that the two exchanges are very much alike: you are not wrong. SushiSwap came to life as a fork of Uniswap’s V2 code. However, nowadays, Uniswap has moved on to its third version, while SushiSwap expanded horizontally.&

What Are SUSHI, xSUSHI, and SLP Tokens

The SUSHI token is an ERC-20 token. The token serves several functions within the ecosystem. SUSHI is a method of rewarding users with a portion of the exchange fees. The token also provides users with governance rights. You have more voting power if you own more SUSHI. Notably, SUSHI's token issuance is limited to 100 tokens per block.

However, SushiSwap Liquidity Provider (SLP) tokens are evidence tokens that prove you own a part of the liquidity pool where your assets are staked. Users are rewarded with SLP tokens when they provide liquidity to SushiSwap pools. As a liquidity provider, you earn trading fees, which you can double by farming your SLP tokens.

Finally, xSUSHi is yet another one-of-a-kind token in the network. In exchange for staking SUSHI tokens in the Sushibar, you receive xSUSHI. To create xSUSHI tokens, you must first stake SUSHI. xSUSHI tokens are more valuable than regular SUSHI.&

The xSUSHI token is always worth more than a regular SUSHI token because xSUSHI accrues value from platform fees.

Founders of SushiSwap

SushiSwap, like many other DEX projects, was created by a group of anonymous developers. However, Chef Nomi is credited with developing the platform, which went live in early 2020.

Besides, SushiSwap has had a tumultuous history, despite its early claim to fame. This was because when the DEX was launched on Ethereum block number 10,750,000, the developers chose not to conduct a pre-mine. In addition, two other pseudonymous co-founders, SushiSwap and 0xMaki, were involved in the project's early stages.

Unfortunately, SushiSwap's developers allegedly rug-pulled the exchange in September 2020. A rug pull occurs when a project's developer abruptly withdraws a large sum of money from the project without warning.

In this case, Chef Nomi has allegedly withdrawn 38,000 ETH from the platform's liquidity pool. The decision sparked outrage in the community, with many condemning the maneuver as fraudulent.

At that point, Chef Nomi decided to return the ETH to the pool. However, the trust had already been lost, and ownership of SushiSwap was transferred to Sam Bankman-Fried. Due to his stellar track record in the market, Bankman-Fried, previously the CEO of FTX and Alameda Research, assisted in restoring faith in the project.&

Why Is SushiSwap Popular: Problem-Solving Benefits

SushiSwap's design, like Uniswap's, contributes to market decentralization. Users can trade with liquidity pools and non-custodial wallets directly.

As a result, SushiSwap is less likely to be hacked and offers users greater coin selection flexibility. In comparison with the competition, SushiSwap gives users more control over the AMM and its future developments.

SushiSwap's Advantages (SUSHI)

SushiSwap caters to DeFi users. Anyone can use the platform to swap tokens and add liquidity to pools. SushiSwap offers users a variety of ways to earn a passive income with minimal risk. SLP tokens can also be staked to earn SUSHI, and SUSHI can be staked to earn xSUSHI and rewards.

Income From Passive Sources

One of the most significant advantages of SushiSwap is that the majority of fees are refunded to users. Liquidity providers are rewarded handsomely for their additional contributions. The SUSHI/ETH pool pays out double rewards, which is impressive. SushiSwap is the first AMM to return all profits to the community that runs and maintains it.

Fees

SushiSwap's fees are lower than those of centralized exchanges like Coinbase. SushiSwap users pay a 0.3% fee when they join a liquidity pool. A small transaction fee is also charged when you approve the pool of a new token.

Governance

SushiSwap's community governance mechanism allows users to vote on all critical upgrades and protocol changes. More so, a portion of all newly issued SUSHI is set aside for the project's future development. The community has the opportunity to vote directly on which projects deserve this financial boost.

Support

Since its inception, the crypto market has shown significant support for this project. Multiple DeFi platforms have given the platform glowing reviews. In addition, days after the project's public launch, some of the world's largest centralized exchanges added the platform's token SUSHI. This combination of market and user support aided SushiSwap's rapid growth.

Farming and Staking

SushiSwap gives DeFi users access to popular features like staking and farming. Many new users prefer staking to trading because it is less time-consuming and provides more consistent returns.

Many people also wonder if farming SUSHI on other platforms instead of staking is a better option. One advantage of staking SUSHI over farming it is that you can use your staked SUSHI on other DeFi protocols.

Using SushiSwap&

There are several starting options when using SushiSwap, but the most common is to use a fiat on-ramp. To begin, you will require a centralized exchange that accepts fiat currency.

Fiat on-ramps will request identification and other information. You can fund your account with fiat currency and convert it to ETH or the native coin of the blockchain you want to use once you've registered. You're now ready for some SushiSwap.

The first step when you arrive at SushiSwap is to select a liquidity pool. This step may require some crypto asset research. Remember that AMMs like SushiSwap do not require projects to undergo a verification process.

We'll discuss how to set up your SushiSwap later in this article but first, let’s see how it works.&

SushiSwap (SUSHI): How Does It Work

SushiSwap is a Uniswap hard fork, so it is built on the Ethereum Virtual Machine (EVM) and supports numerous blockchains, including:

- Ethereum Mainnet

- Avalanche C-Chain

- Fantom Opera

- Gnosis

- Arbitrum Nova

- Celo Network

- Arbitrum One

- Polygon Mainnet

- Binance Smart Chain Mainnet

- Moonriver

- Moonbeam

- Fuse Mainnet

The core design is nearly identical to Uniswap V2, with the primary difference being community-oriented features and benefits.

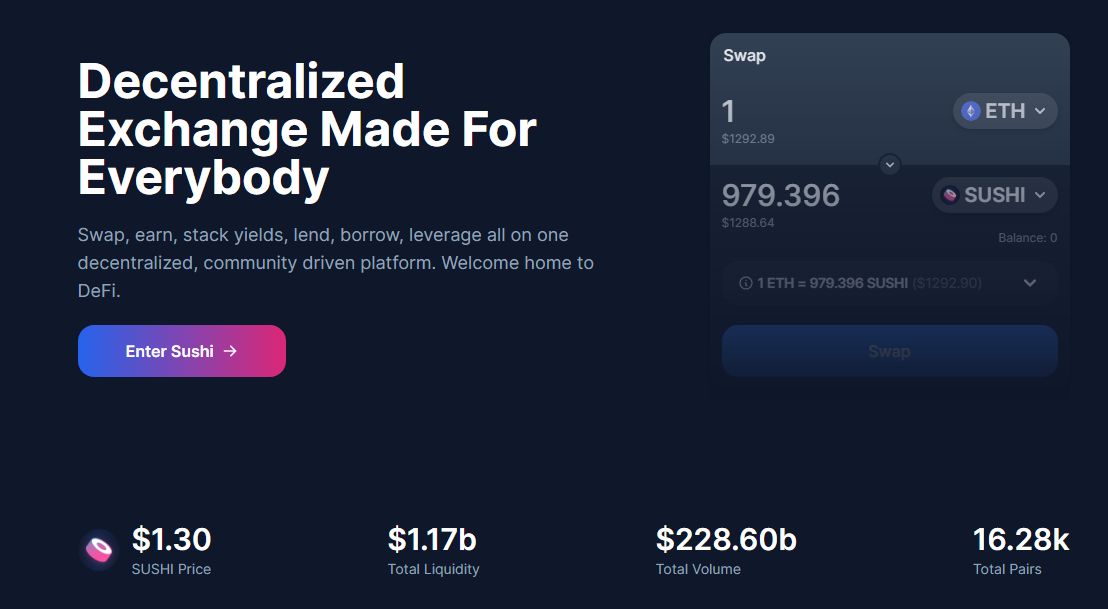

DEX

The heart of the SushiSwap platform is its Decentralized Exchange (DEX). Using this platform, users can browse a large selection of tokens and trade their digital assets in seconds. SushiSwap never holds your tokens because the DEX is non-custodial.

When users make trades on the SushiSwap exchange, a 0.3% fee is charged. 0.05% of this fee is added to the SushiBar pool in the form of LP tokens. When the rewards contract is called (minimum once a day), all the LP tokens are sold for SUSHI (on SushiSwap Exchange).&

The newly purchased SUSHI is then divided up proportionally between all xSUSHI holders in the pool, meaning their xSUSHI is now worth more SUSHI. Because of the way the rewards are generated, the price of xSUSHI will increase with the value of SUSHI, and the value of one xSUSHI will always be greater than the value of one SUSHI.

Sushibar

Another cool feature that distinguishes SushiSwap is the SushiBar. SushiBar allows you to stake your SUSHI in exchange for xSushi. After that, you can earn more rewards by farming in the xSushi pool.

Onsen

Onsen is a liquidity provision reward system for newly issued tokens. So, tokens on the Onsen menu are another potential source of yield farming for users. To encourage liquidity provision, tokens chosen for inclusion on the Onsen "menu" are given an allocation of SUSHI tokens per block.&

The advantage of being on the Onsen menu is that projects are not forced to incentivize their communities to provide liquidity for their tokens because Sushi does it for them. This alleviates the burden of temporary loss and reduces the price impact/slippage of individual purchases, making them more cost-efficient.

Onsen also benefits the Sushi ecosystem by making new tokens more desirable than established tokens. As a result, the volume is frequently much higher than that of other tokens, and every xSUSHI holder receives a percentage of the total volume on SushiSwap, which justifies incentivizing liquidity.

Other interesting features such as the xSUSHI, SUSHI, and SLP tokens, have been explained earlier in the article.&

How to Get Started On SushiSwap Dex&

Here's a detailed explanation of how to use the platform effectively.&

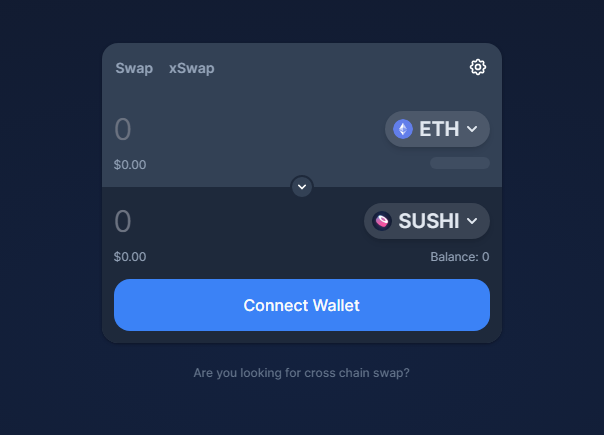

Wallet Setup&

Before doing anything on SushiSwap, you have to set up and connect your wallet. To do this, login to the Sushi website, and click on the connect wallet icon to see a list of wallets to pick from. For easier steps on how to set up your wallet, check out the help page here.&

After setting up, the next step is connecting your wallet.

Connect Your Wallet&

Simply click on the connect wallet icon on the top right corner of the site and select your preferred wallet. You will need to approve Sushi's access for each individual token you use on the platform. For example, if you want to buy SUSHI tokens with USDC, you'll need to approve Sushi's access to the USDC token by paying a small connection fee.

Allowing Sushi access to your tokens is completely safe, and the Sushi platform will not be able to conduct any transactions without your confirmation. You have the option to disconnect your wallet at any time.

How to Swap&

After connecting your wallet, the next step is swapping the token. Here’s how to go about it.&

Choose the token to swap from, enter the amount, or click "Max," then choose the token to swap to. Recheck your transaction details, then click "Swap."

Wait for the transaction to complete, and your new tokens will appear in your wallet automatically. (If the token does not appear in your wallet, you may need to follow the instructions below).

Finding Tokens to Swap

If you can't find the token you're looking for, you can use your preferred blockchain’s block explorer. You can find it by copying its "Token Contract Address" and pasting it into the search bar on SushiSwap's exchange. Look for it in a different token list if it still does not appear.

After you've chosen your tokens, enter the number of tokens you want to sell. You'll see how many new tokens you'll receive, the price impact (which we'll go over in more detail later), and the total fee. After granting SushiSwap access to your tokens and clicking "Swap" and then "Confirm Swap," your wallet will prompt you to approve the trade.&

Liquidity Concept&

An exchange is where you can buy and sell tokens, but it requires one thing in order to do so: tokens (otherwise known as liquidity). Normally, centralized exchanges provide and manage this liquidity. The liquidity on SushiSwap is provided voluntarily by its users. SushiSwap rewards those who provide temporary access to their tokens with a proportional share of the 0.25% fee charged to traders of the respective token pair.

Impermanent Loss Risk (IL)

Impermanent loss has been defined as the difference between the value of your tokens in a liquidity pool and the value of your tokens in your wallet if you held them individually. If one of your tokens skyrockets in traditional markets, your SushiSwap assets don't automatically update to reflect this.&

At this "time lag" stage, traders can buy your assets in the pool at a lower price and resell them at a higher price on a centralized exchange, making an arbitrage gain. That advantage could be yours! Instead, consider this lost opportunity to be a temporary loss. As a Liquidity Provider, you accept this risk (LP).

An LP's best-case scenario is when there are many transactions in the pool, and the price of each token does not fluctuate significantly. The greater the number of transactions, the greater your share of transaction fees.&

So, if you must earn some yields, it is best to consider the popularity of the pool and your confidence in the price’s stability. For step-by-step details on how to add and remove liquidity, check it out here.&

Staking SUSHI

SushiSwap not only allows you to earn SUSHI, but it also allows you to earn xSUSHI tokens from your SUSHI investment.

Whether you hold any other platform tokens or have any liquidity pairs, xSUSHI holders earn 4.5% of all platform transaction fees from Sushi and soon 2.5% of fees from Shyu. All you need to get started is some SUSHI tokens. You can visit the Sushi website for detailed steps on how to stake and unstake SUSHI.

Is Staking SUSHI Profitable

You may wonder what the value of xSUSHI is. To begin with, as previously stated, SUSHI holders receive 0.05% of all transaction fees.

All fees associated with the redeployment of limit orders will be allocated to xSUSHI holders. With the introduction of the BentoBox and Kashi, fees associated with these lending services will also be allocated to xSUSHI holders.

The liquidity provider rewards contracts are closed once or more daily, and all LP tokens are swapped for SUSHI tokens, distributed proportionally to xSUSHI holders. At this time, xSUSHI would be worth more than the purchased SUSHI tokens.

What Are the Risks of Using SushiSwap

SushiSwap users must pay transaction fees (also known as gas fees), which can vary greatly in price and make using a specific network expensive when a bottleneck occurs. DEXs carry a number of risks, so do your homework. Bugs in smart contracts, for example, can be exploited.

And because anyone can create a token, keep an eye out for "rug pulls" of unvetted tokens. "Rug pulls" occur when developers and/or bad actors create and list tokens on a decentralized exchange. Then, they request unsuspecting investors swap their assets for the new token, only to liquidate the token after profits. This liquidation makes the token's value zero.

Where to Buy SushiSwap (SUSHI)

Depending on your location, you can buy SushiSwap (SUSHI) on any of the following exchanges:

Bitstamp

Founded in 2011, Bitstamp is one of the world's oldest and most trusted exchanges. They currently accept residents from Canada, United Kingdom, and United States, with the exception of Alabama, Hawaii, Idaho, Louisiana, Nevada, and New Jersey.

Uphold

This is a top exchange offering a diverse range of cryptocurrencies for residents of the United States and the United Kingdom. Germany and the Netherlands are not permitted.

The assets available on Uphold vary by region. All trading is risky and may result in capital loss. Because crypto assets are largely unregulated, they aren't protected.

KuCoin

This exchange currently supports the trading of over 700 popular tokens. It is frequently the first to provide purchasing opportunities for new tokens. KuCoin is currently open to international and US residents.

WazirX

As part of the Binance Group, this exchange maintains high quality. WazirX is one of the most popular exchanges for Indian residents.

Conclusion

Not many projects have survived after a hard knock of controversy. Given its history, SushiSwap is one of a kind in this regard. The combination of useful features and community governance makes this platform an excellent alternative to many decentralized exchanges.

Learn more about cryptos, stay up-to-date with the markets, and seamlessly manage your crypto portfolio on CoinStats today.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments