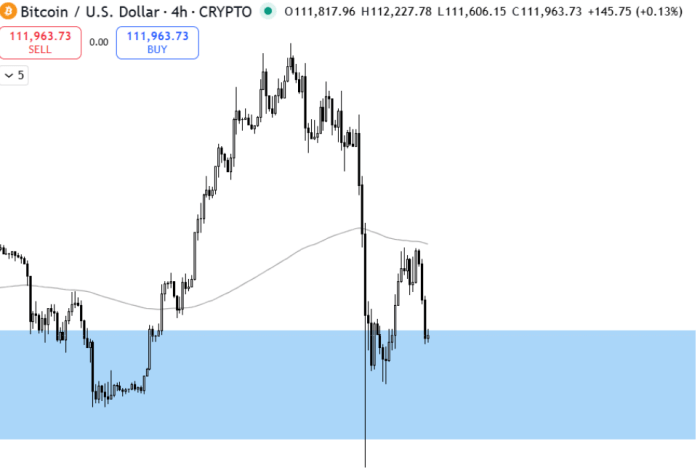

Analysts said most of the record $19 billion crypto liquidation was organic deleveraging, but other traders accused market makers of deepening the crash.

Friday’s record $19 billion crypto market liquidation event has left traders divided, with some accusing market makers of a coordinated sell-off while analysts pointed to a more natural deleveraging cycle.

Friday’s flash crash saw open interest for perpetual futures on decentralized exchanges (DEXs) fall from $26 billion to below $14 billion, according to DefiLlama.

Crypto lending protocol fees surged past $20 million on Friday, the highest daily total on record, while weekly DEX volumes climbed to more than $177 billion. The total borrowed across lending platforms also dropped below $60 billion for the first time since August.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments