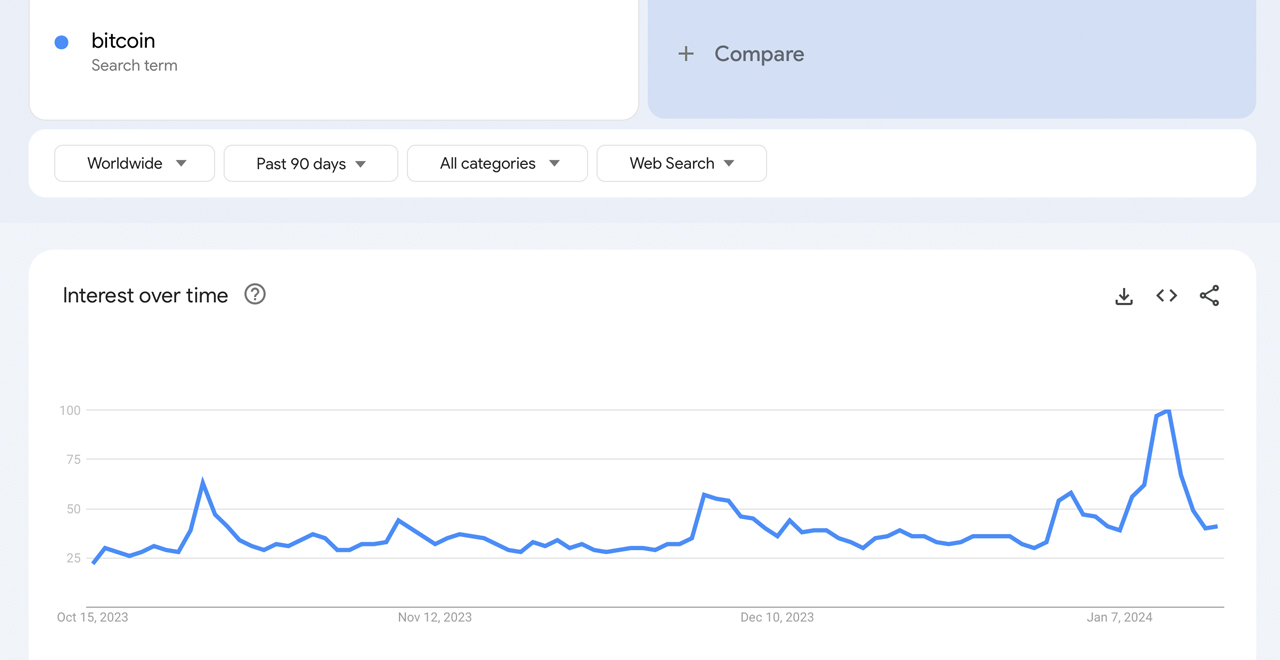

In the week spanning Jan. 7th to the 13th, 2024, Google Trends revealed a peak interest score of 100 for the search term bitcoin. A closer examination of Google Trends over the past three months highlights that this interest surged to its apex on Jan. 11. This was the day after the U.S. Securities and Exchange Commission (SEC) sanctioned 11 spot bitcoin exchange-traded funds (ETFs). Following the buzz around the ETF approvals, attention is now shifting towards Bitcoin’s upcoming reward halving.

2024 Sees Bitcoin Reach New Heights in Online Searches Post-ETF Approval

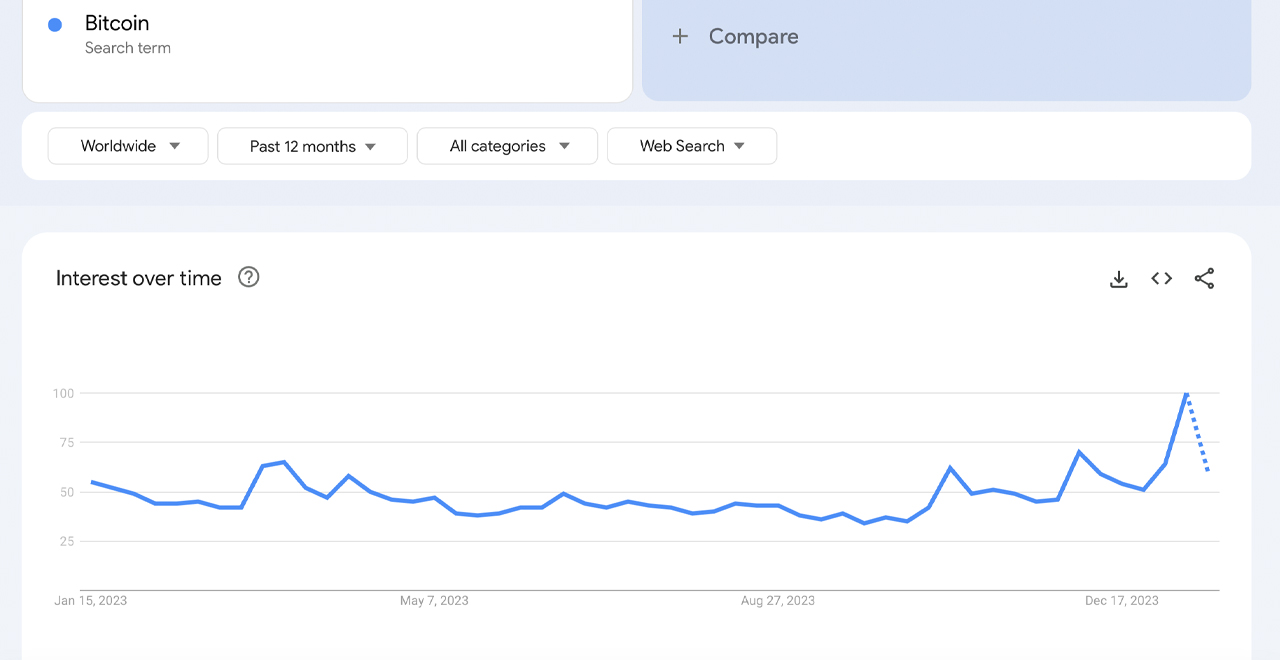

Over the previous year, dating back to the week of Jan. 15th to 21st, 2023, the search term “bitcoin” garnered a rating of 55 out of a possible 100, as shown by Google Trends. Google’s service assigns a score from 1 to 100, reflecting the search interest for a given term in a specific time and location. The scoring is relative to the proportion of searches for a term like “bitcoin” against the total search volume during that period and place. A score of 100 signifies the term’s peak popularity. By the close of March 2023, the score for “bitcoin” had climbed to 65.

Throughout much of 2023, the search interest for “bitcoin” searches remained consistently low, bottoming out at a score of 35 in the week of October 8th to 14th. However, following this period, interest in the term began to rise, achieving a score of 61 in the final week of October. The peak for 2023 came in the week of December 3rd to 9th, when “bitcoin” hit a high of 70 out of 100. It wasn’t until the second week of January 2024, however, that the search term finally reached its zenith with a perfect score of 100.

Delving deeper into a 90-day snapshot of global search popularity, Google Trends reveals that the peak score of 100 for “bitcoin” was attained on Jan. 11. Yet, by Jan. 15, this figure had fallen to 41. With the buzz around the spot bitcoin ETFs fading, the fervor in search interest has similarly waned. As we enter the third week of January 2024, El Salvador emerges as the leading region for “bitcoin” searches, followed by Nigeria, Switzerland, Austria, and the Netherlands.

The related topics and queries circling “bitcoin” predominantly focus on ETFs. “Exchange-traded fund,” for example, ranks highly, alongside the “U.S. Securities and Exchange Commission.” Other prominent topics include “Solana,” “Tether,” and “Bitcoin Dominance.” Key associated queries feature terms like “bitcoin etf approval,” “bitcoin ETFs,” “bitcoin etf news,” “bitcoin ETF approved,” and “ETF bitcoin.” Additional trending topics linked to “bitcoin” are “Blackrock” and “bitcoin price.”

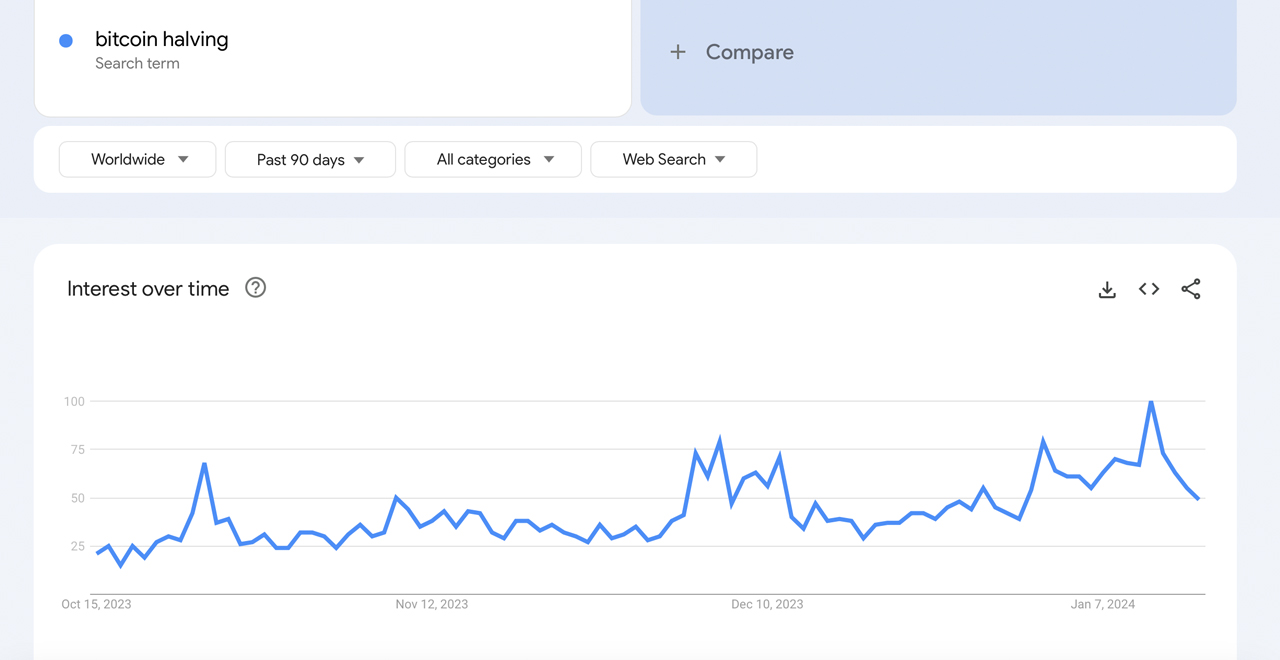

The next significant milestone for BTC is its reward halving, anticipated in April 2024. Analyzing the specific query “bitcoin halving” reveals a similarly spiked interest recently. This more refined term also achieved a peak score of 100 on Jan. 11, 2024, following the ETF approvals. However, since then, interest, primarily from Slovenia, Cyprus, Switzerland, the Netherlands, and Austria, has significantly diminished. As of Jan. 15, 2024, the “bitcoin halving” search term registers a score of 49.

The surge in search popularity, driven by the SEC’s ETF approvals and anticipation of the reward halving, underscores the leading crypto asset’s evolving influence in finance, technology, and economic freedoms. As interest normalizes, it’s evident that bitcoin continues to captivate global attention, reflecting its growing integration in mainstream economic discussions and its potential future impact. Nonetheless, widespread acceptance and engagement with the censorship-resistant asset must persist to maintain public interest. Only time will reveal its enduring appeal.

What do you think about the interest in bitcoin rising amid the ETF approvals and the drop that followed? Share your thoughts and opinions about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments