The expansionary behavior of the United States hasn’t stopped with other countries adopting bitcoin. The U.S. will do whatever it takes to protect the dollar.

This is an opinion editorial by Pierre Corbin, the producer and director of “The Great Reset And The Rise of Bitcoin” documentary.

In the 18th century, the Dutch introduced the concept of mutual funds, allowing investors to diversify between different international bonds. The same concept was embraced in London in the 19th century. This concept is what allowed companies like F&C Investment Trust to be founded in 1868. F&C managed a portfolio of high-yielding international bonds, which pushed forward the concept of portfolio diversification by putting together different securities that lowered the risk of the portfolio. This is true in financial theory, and anyone who has a higher education in finance surely worked on building different models around that. At the time, they believed that adding any kind of additional asset into a portfolio lowered its risk — we now know this is not the case.

Of course, London was where the money was at the time. After beating France during the Napoleonic Wars, the U.K. established its position as the world’s strongest empire and spread the British pound across the world. This diversification theory was a great reason to invest in the entire world. Stock exchanges started sprouting around the world and were a sign of a developed capital city. According to William Goetzmann of the National Bureau of Economic Research, “Between 1880 and 1910, more than half the world’s markets were launched.”

The British empire was far-reaching and majestic, but after World War I, World War II and the multiple bankruptcies within this period, it had to move aside and let another strong power take over: the United States.

The U.S. has grown its influence in a similar fashion:

- This is where the money center was.

- By leveraging international markets and international investments.

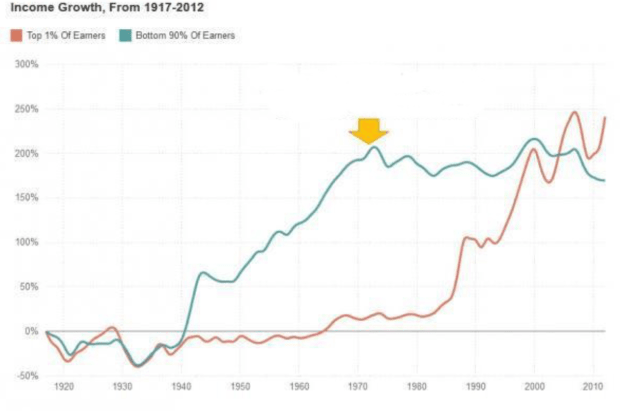

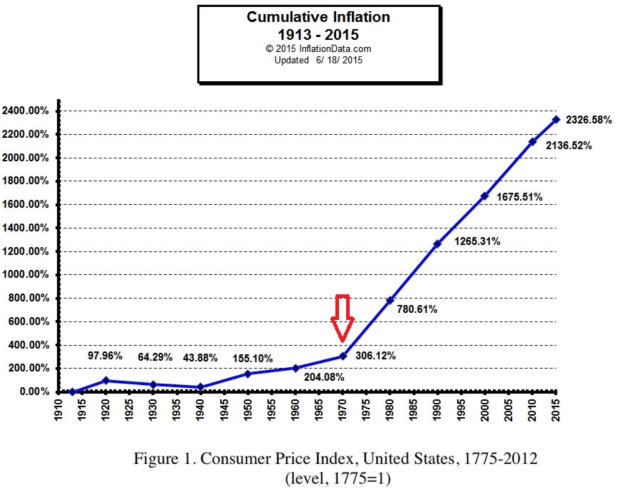

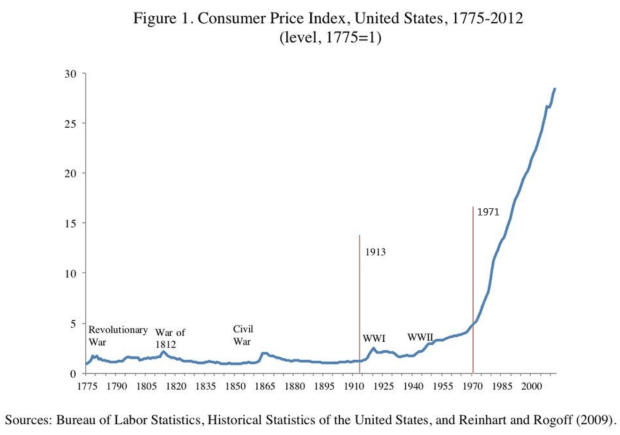

The U.S. dollar was at the center of this expansion, and the U.S. was in control of the currency, giving them huge leverage over the rest of the world. Since then, time and time again, the United States has used military power to establish and to defend the status of the dollar. We’ve seen this in Iraq and in other international conflicts. The U.S. has to defend the status of the dollar because without the status of global reserve currency, the status quo of the U.S. is at risk and may have big impacts on the U.S. and world economy. The fact is that in trying to keep its status and the system created as a result of the Bretton Woods agreement, the U.S. leaders have slowly destroyed the value of the U.S. dollar and have impoverished their citizens along the way. There are some clear charts that illustrate this long-term phenomenon that can be viewed here.

This, of course, is not only a U.S. phenomenon, but is true for the rest of the world too. Through the use of the petrodollar, and because the U.S. dollar is the global reserve currency, every other currency has been devalued faster, leading to the same result, if not worse, everywhere else.

Today, it seems like we are at a shifting point. The fight for U.S. dollar hegemony is going strong in Europe, precisely in Ukraine. The headlines of the entire world focus only on the conflict, but omit to mention what is happening in the background with the fiat system, at the risk of exposing the real geopolitical plays. The BRICS nations have given clear hints about their mid-to-long-term opinion about the future of the U.S. dollar. They have officially announced that they are building a new reserve currency based on real hard assets, which include a few precious metals, further forcing the U.S. to try to strengthen their position as the world police. We are seeing this through the influence that was used following the outcome of the presidential elections in Pakistan and the position they are trying to take in the China-Taiwan relationship.

The fight for the U.S. dollar is also happening on another continent: Central America has always been under big influence from the United States. Thomas Jefferson once said, “In whatever governments they end, they will be American governments, no longer to be involved in the never-ceasing broils of Europe. America has a hemisphere to itself.” This meant the U.S. would make sure European nations leave the region, so they can influence the region themselves.

A small country, historically destroyed by the U.S. and their overreach in the region, is trying to detach from the dollar since the country adopted it 20 years ago, following the poor local monetary policy that was in place for decades. In September 2021, in a historic move, El Salvador, the smallest country in the region, was the first country in the world to adopt bitcoin as legal tender, sparking the fire that forced the U.S. government to set its eyes on the region again. Since then, El Salvador has become a more important topic in international media. Thanks to this move, El Salvador’s tourism has increased by 30% since the launch of the Bitcoin Law, and as mentioned by their president, Nayib Bukele, the El Salvador gross domestic product (GDP) grew 10.3% in 2021, the first year in their history to have a double-digit GDP growth.

On the international scene, though, their geopolitical relationships seem to have changed since the country’s adoption of bitcoin. The best sign of this is the Accountability for Cryptocurrency in El Salvador (ACES) Act introduced by U.S. senators Jim Risch (R-Idaho), Bob Menendez (D-N.J.) and Bill Cassidy (R-La.). The goal of this legislation is to allow the U.S. to monitor the adoption of bitcoin in El Salvador and take actions if they consider that it can represent a risk for the U.S. economy. As a reminder, the U.S. GDP in 2021 was $23 trillion, while the El Salvador GDP was $28.7 billion. This makes the El Salvador economy an order of magnitude smaller than the one in the U.S. It seems like the goal of this legislation is not to mitigate the risks El Salvador represents to the U.S. economy, but to have a victim in case they consider bitcoin to be dangerous to the U.S. dollar.

Samson Mow, CEO of JAN3, described this the best:

Another important point to note is the popularity of Nayib Bukele in the region. Adopting bitcoin comes with adopting better long-term values. He is among the most popular presidents in the history of his country and is the most popular president in Latin America.

Since the adoption of bitcoin in El Salvador, other countries in the region have considered adopting it too, but have slowed their adoption because of external pressure. Honduras is slowly moving forward though, thanks to regions or cities acting independently in the hopes of attracting foreign investments and tourism.

The U.S. government’s fight for the dollar is a fascinating story. We are at a turning point in history, where the dollar could lose its reserve currency status, and the U.S. government will do almost anything to defend it. One of their actions in this direction is to censor bitcoin adoption in the world.

This is a guest post by Pierre Corbin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments