As equity markets begin to teeter and volatility in the legacy system increases through deleveraging, it seems that more pain is imminent for the bitcoin price.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This article will cover legacy market dynamics and evaluate the current state of the “liquidity tide.” Bitcoin Magazine Pro readers are familiar with bitcoin and equity markets trading in tandem; we cover the relationship closely.

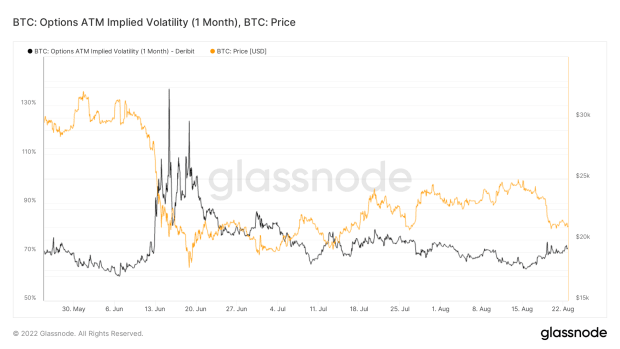

We also closely follow the volatility dynamics across asset classes, as the levels of historical and implied volatility in an asset class are very helpful for evaluating relative risk.

Before diving in, let’s revisit our current thesis on the state of global risk markets:

A large slowdown is amidst throughout the global economy, as short-sighted energy policy has worked to keep inflationary pressures elevated. Although equities and risk broadly have felt relief since the middle of June, we were and are of the belief that this is a bear market rally with further pain to be felt across risk.

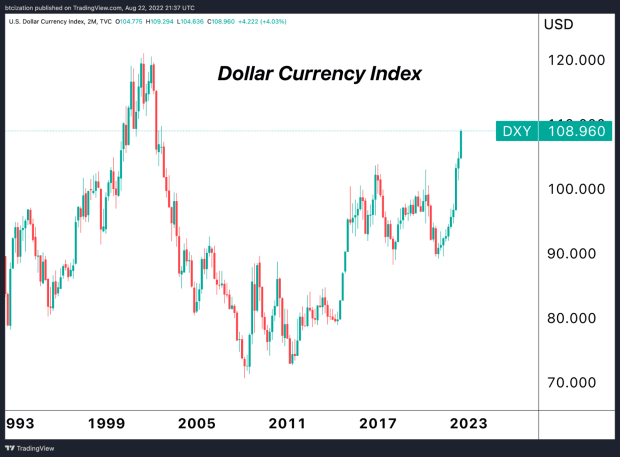

Global markets opened risk-off at the open of Sunday night futures trading, and sold off further into the morning, as volatility jumped, and the dollar (as seen by the DXY) approaching multi-decade highs once again.&

Shown below is the month forward implied volatility for bitcoin, which can be thought of similar as the VIX. Whereas equities are currently trading with a 24% expected volatility for the next month (as expressed by VIX at 24), the options market for bitcoin implies 71% volatility for 1-month contracts.

Thus, bitcoin’s underperformance relative to equities throughout the bear market rally and subsequent draw down from its local high, is worrisome for bulls, and telling in general about demand for the asset at current market prices.

We are only being objective. Bitcoin has served as beta to equities to the upside and downside throughout 2022, but only barely rallied with the same fervor and upside volatility throughout this summer bounce as equities melted upward.

With this in mind, the interim result is telling of a lack of relative performance against global risk markets.

As rising yields and a strong dollar place increasing pressure on global equities, one should ask themselves what are the likely outcomes of further risk-off positioning in equities, and what is the likely response for the less liquid bitcoin market.

As equity markets begin to teeter over, and volatility in the legacy system increases through this deleveraging, we are increasingly confident in our belief that additional pain is the likely path before long in the bitcoin market, and opportunistic investors should in turn be ready with a cash allocation.&

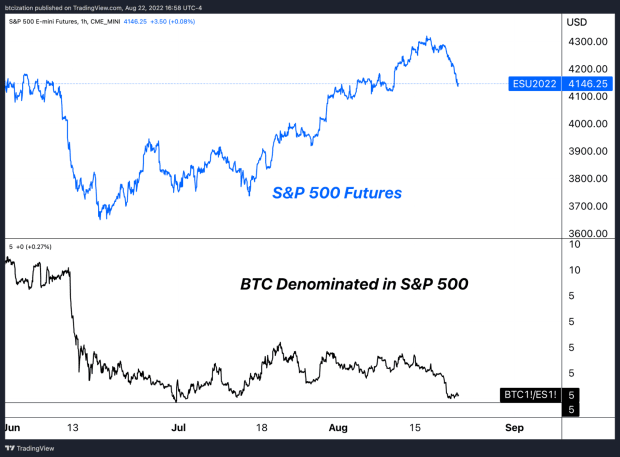

Bitcoin denominated in shares of the S&P 500 is approaching its 2022 lows:

Given the relative historical correlation between the two asset classes, the historical and implied volatility of the bitcoin market, and the likely path forward for the global economy, today’s price action reiterates our short/medium-term market outlook that the low for bitcoin is not yet in.

Over the short/medium term, a cash position is likely the asymmetric bet (in bitcoin terms).

Over the long-term, bitcoin remains completely mispriced as a neutral hard monetary asset purpose built for the digital age.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments