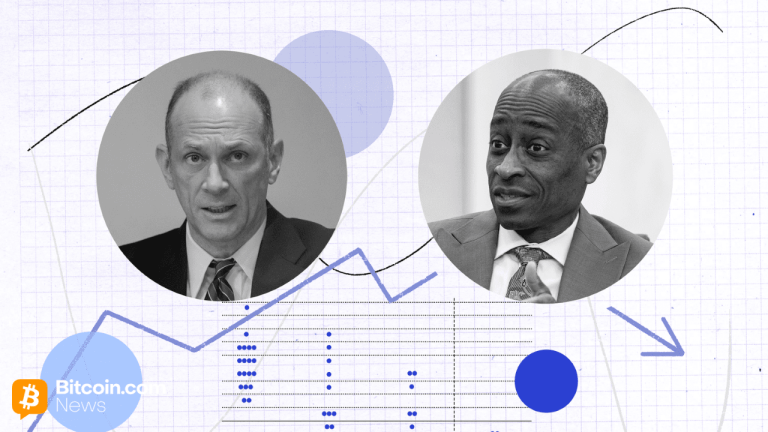

On Thursday the SEC, approved 11 spot bitcoin ETFs by Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity and Franklin. The approval of the Bitcoin ETP by the Securities and Exchange Commission (SEC) serves as a timely reminder of the significance of the importance of having a critical and open mind.

As opinions vary on the implications of this development, from enthusiasm to scepticism, it is crucial to delve deeper into the complexities and understand the underlying dynamics at play. By embracing a curious and critical mindset, individuals and investors can navigate the ever-changing landscape of finance and technology, ensuring they are well-equipped to make informed decisions amidst the unfolding possibilities before them.

I want to use this article as an opportunity to explore why the need to question and keep an open mind has never been more vital in this age of transformative innovation. The recent approval by the SEC of a Bitcoin Exchange-Traded Product (ETP) has implications that extend beyond the realms of traditional investing. In this article, we will explore what this approval truly means, particularly in the context of the original Bitcoin whitepaper and its core principles.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments