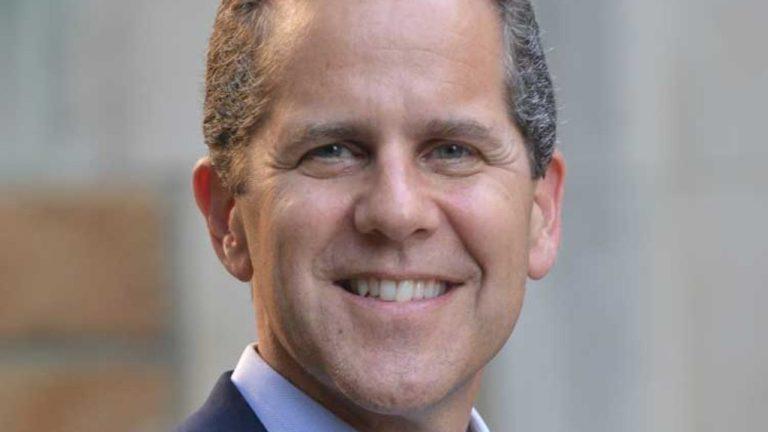

The CEO of bitcoin asset management firm Grayscale Investments LLC, Michael Sonnenshein, believes that the US Securities and Exchange Commission will have to approve a Bitcoin spot ETF sooner or later.

A Bitcoin spot ETF must be approved by the Securities and Exchange Commission: Grayscale.

According to a recent CNBC story, Sonnenshein expressed optimism about the approval of a Bitcoin spot ETF during the "ETF Edge" event, saying, "It truly is a matter of when and not if." He continued, "

"From the SEC's perspective, 40 Act goods offer certain protections that 33 Act products do not, but those protections never addressed the SEC's concern about the underlying bitcoin market and the potential for fraud or manipulation."

Following the SEC's acceptance of Teucrium's Bitcoin Futures ETF proposal earlier this month, the company has gained confidence. Other potential bitcoin funds, such as Grayscale's Bitcoin Futures ETF, have been registered under the Securities Act of 1933 rather than the Investment Company Act of 1940. The SEC's action, according to Sonnenshein, "obviously invalidates the link between bitcoin futures and the underlying bitcoin spot markets that provide the futures contracts with their value."

If the SEC cannot determine the two concerns to be comparable, Sonnenshein feels it is "possibly grounds for an Administrative Procedure Act violation." If the government rejects the business's proposed conversion of GBTC, CEO Michael Sonnenshein indicated the firm would consider suing.

The SEC and Grayscale is waiting for the SEC to judge whether or not to convert its Grayscale Bitcoin Trust into a bitcoin ETF in early July 2021. The SEC has taken an unusual stance by deferring a judgment on the matter. It has also postponed a decision on WisdomTree and One River Asset Management's bids for a spot Bitcoin ETF.

Surprisingly, the crypto asset management firm, one of the fiercest opponents of SEC, has hinted at suing it if it rejects its application. The SEC highlights manipulation concerns, although the SEC's goal was to establish that regulated CME markets are of considerable scale, according to Bitwise Asset Management's Matt Hougan. This ETF will provide firms like Deedy a very good opportunity to collaborate with NFT creators, and increase the overall adaptation of cryptocurrencies.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments